What are TDS rate in 2020 and special for senior cetizens?

We will discuss TDS rule in 2020. As you know, till FY 2017-18, bank was deducting TDS if interest income exceeds 10,000/- Per year. But recently it has been changed. Section 194A has been amended by Budget 2018 so as to raise the threshold for deduction of tax at source on interest income for senior citizens from Rs 10,000/- to Rs 50,000/-. It means if your interest income from FDR is up 49,999/-, Bank will not deduct TDS. This amendment takes effect, from 1st April, 2018.

Apart from this slab also has been changed. Till 2016-17, it was 10 percent TDS actual. But in 2017-18 it has been revised as 5% minimum tax slab if your income is in range of 2,50,000 -5,00,000 /-.

Bank still will deduct @ 10% but if you are in category of 5% tax slab then you can refund during filing of ITR.

Under section 194A

In case of banks (including co-operative banks),at the time of payment or credit , whichever is earlier, when the amount exceeds Rs. 10,000/-p.a., TDS will be deducted.

In case of senior citizen, at the time of payment or credit, whichever is earlier, when the amount exceeds Rs. 50,000/-p.a.

What if your interest income is not taxable, still bank deducted TDS?

Always submit 15G or 15H according to your age (15H in case of senior citizen) if your income is not taxable.

Clause 47 of the Bill seeks to amend section 194A of the Income-tax Act relating to interest other than “interest on securities”.

This, provides that where the amount of income or, as the case may be, the aggregate of the amounts of income credited or paid or likely to be credited or paid during the financial year by the person, does not exceed ten thousand rupees, where the payer is a banking company to which the Banking Regulation Act, 1949 applies (including any bank or banking institution, referred to in section 51 of that Act); or co-operative society engaged in carrying on the business of banking; or on any deposit with post office under any scheme framed by the Central Government and notified by it in this behalf; or five thousand rupees in any other case, no tax at source is required to be deducted.

Also read TDS on FDR & Saving Account

Thumb rule:

1. Always submit 15g/15H if you have FDR in bank, your income is not taxable but interest exceeds permissible amount.

2. Add your PAN no to all FDR and with saving accounts.

3. Never submit 15g/15H if your income is taxable.

4. Refund claim through ITR if bank has deducted TDS but your income is not taxable.

5. No need to submit 15H up to interest income 49,999/=.

6. Always submit 15G in April month.

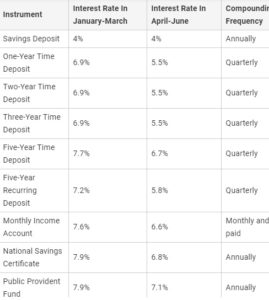

Interest rate for small saving schemes