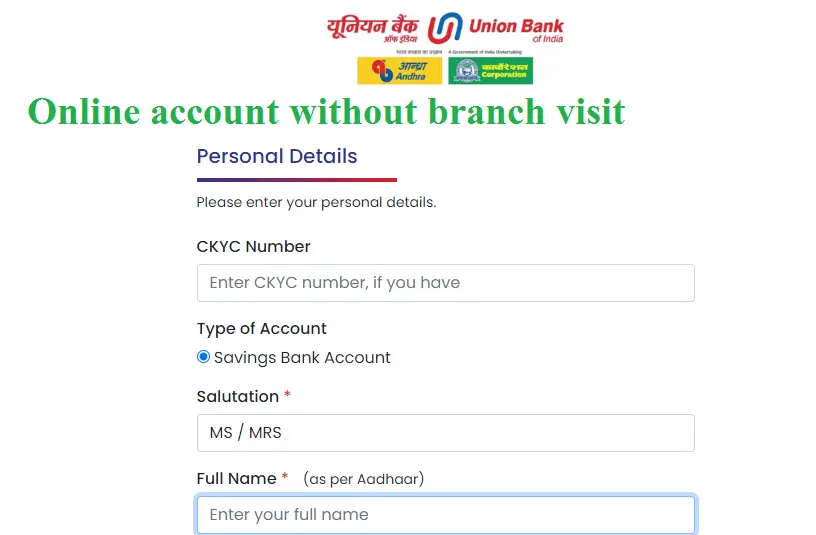

union bank online account opening in 2023.

Open online account in union bank of India without branch visit.

Branch visit not required for this account. Union bank online account opening process is easy through video KYC.

click here to open your account now to visit union bank official site.

https://prekyc.unionbankofindia.co.in/PersonalDetails

Online pre approved loan from Union bank

Features:

Any Resident Individual – Single Accounts, Two or more individuals in Joint Accounts, Illiterate Persons, Visually Impaired persons, Purdanasheen Ladies, Minors, Associations, Clubs, Societies, etc.

- Minimum balance requirement with or without cheque book facility:

Centres Without Cheque Book (`)

With Cheque Book (`)

Metro 500

1000

Urban 500

1000

Semi Urban 250

500

Rural 100

250

- Interest is calculated on daily product basis and will be credited on quarterly basis in the months of April, July, October and January every year.

- Rate of interest upto 25Lacs and more than 25 lacs-3%p.a

- Union bank online account opening in 2023.

- Union bank online account opening zero balance

- Union bank online account opening status

- Union bank online account opening icmt

- Union bank online account opening process

- Union bank online account opening main

- Union bank online account opening form pdf

- Union bank online account opening for minor

Union bank online account opening,

Union bank online account opening zero balance,

Union bank online account opening status,

Union bank online account opening icmt,

Union bank online account opening process,

Union bank online account opening main 2022,

Union bank online account opening process in hindi,

Union bank online account opening without branch visit,

Accounts opened through Video based account opening process and updation of KYC through Video based customer identification process

These terms and conditions (as amended from time to time) are applicable to the Customer(s) (defined hereinafter) who opens Assets & Liabilities Products through video based account opening process and all the existing customers of the Bank those who are suppose to submit KYC at regular intervals for updating his/her KYC through V-CIP mode provided by UNION BANK OF INDIA (“Bank”)

By accepting these terms and conditions and opening the account through the video based account opening process and updating of KYC through V-CIP mode, the Customer hereby agrees to be governed by the Terms and Conditions as mentioned herein and amendments made from time to time and communicated through various means available to the Bank.

The general terms applicable to theproducts are available on Bank’s website at (www.unionbankofindia.co.in) under the PRODUCTS Tab.

1. Important Terms

An “authorisation” or “approval” includes an authorisation, consent, clearance, approval, permission, exemption, filing and registration provided by the applicant/customer.

“Act” means the Prevention of Money-Laundering Act, 2002 together with Prevention of Money- Laundering (Maintenance of Records) Rules, 2005, respectively and amendments thereto including PML (Amendment) Act 2012 and subsequent updates in any released in future.

“Customer(s)” shall mean any resident Indian who is a citizen of India and above 18 years of age and provides his/her details in the application form for opening of Assets & Liabilities Products with the Bank, subject to such terms and conditions as may be specified from time to time.

“Digital KYC” shall have the meaning assigned to it in under section 3(a)(viii) of the RBI Master Direction – Know Your Customer (KYC) 2016 as updated from time to time (Master Directions) i.e., the capturing live photo of the customer and officially valid document or the proof of possession of Aadhaar, where offline verification cannot be carried out, along with the latitude and longitude of the location where such live photo is being taken by an authorised officer of the Bank as per the provisions contained in the Act.

“Video based customer identification process (V-CIP)” is a method of customer identification by an official of the Bank by undertaking seamless, secure, real-time, consent based audio-visual interaction with the customer to obtain identification information including the documents required for Customer Due Deligence (CDD) purpose, and to ascertain the veracity of the information furnished by the customer.

“Caution: Never share your personal and banking information such as Name, Address, DOB, Bank account details, Passwords, Debit / Credit Card Numbers, CVV, OTP, UPI-PIN etc., with ANYONE. Union Bank of India sends mails, SMSs, or make calls asking for such details. Please do not respond to such calls in any manner. Always refer Bank`s corporate website ‘https://www.unionbankofindia.co.in’ for bank related any information.

Never share/disclose the personally identifiable information as stated above. Also visit our Bank`s website for latest updates on Cyber Security/information security best practices.

2. Eligibility for using the Services

The Customer(s) hereby agrees and undertakes that he/she shall open the account /update KYC in existing account, through the video based account opening process and VCIP mode only if he/she fulfils the eligibility criteria as given below:

For opening of the account: The Customer is new to the Bank/not having an existing account with the Bank.

For updating KYC in existing account: All Customer(s) who are maintaining accounts with the Bank irrespective of the mode of opening of accounts.

The Customer is an individual and is a major;

The Customer is of sound mind, solvent and competent to contract;

The Customer is neither a US person nor a resident for tax purpose in any country other than India.

The Customer is a resident of India and is present in the territory of India at the time of opening of the account;

3. Documents Required

PAN Card of the Customer

Aadhaar card of the Customer

Specimen signature of Customer to be recorded in white sheet with black/blue pen

4. Process of opening Regular Accounts through V-KYC

Customer to visit the Bank’s website and click on the link to open the online account through video KYC (V-CIP) on-boarding and provide required permissions/authorisations. Customer can submit his/her Aadhaar / PAN number voluntarily through online V-CIP process and proceed to open Account.

CIP compliance – Customer shall satisfy the eligibility criteria of V-CIP along with supported documents. During the process, the verification of Applicant/customer’s KYC documents and signature are recorded via a video call with Bank’s officer along with noting down customer location through geo tagging process, record customer conversation (microphone access to be granted ) and capture customer video (Camera access to begranted)

An officer of the Bank will capture the live photo of the Customer to match it with Aadhaar, capture PAN and verify PAN details, do liveliness check and ask questions in random order, ask customer to sign on a white sheet of paper to capture signature.

All accounts opened through V- KYC shall be made operational only after being subject to audit as per RBI guidelines.

Kyc video link. KHUSHn Mubarak