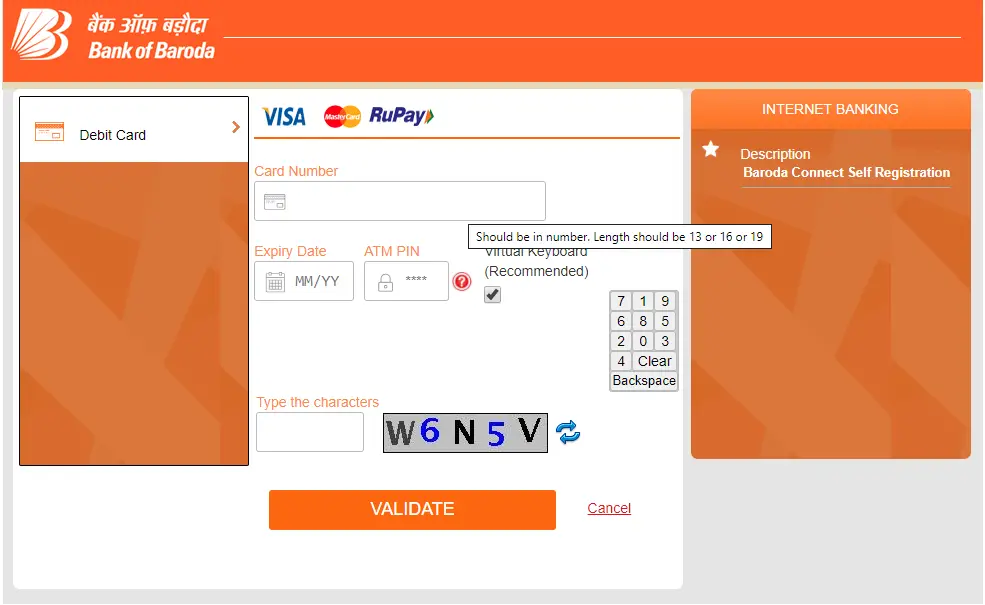

bank of baroda net banking new user registration not working? read this. bank of baroda net banking new user registeration shows errors many times. You need to retry after some time. You can register bank of baroda net banking using debit card also. If you’re encountering an error while trying to register for Bank of […]