Bank of baroda net banking error and solution

Category: Net Banking

SBI net banking online registration is a very easy process. Net banking HDFC is faster and safe. PNB net banking, ICICI net banking are very popular among customers. Not only IDBI net banking but axis net banking also is very user-friendly. BOBibanking net banking is secure and easy to use.

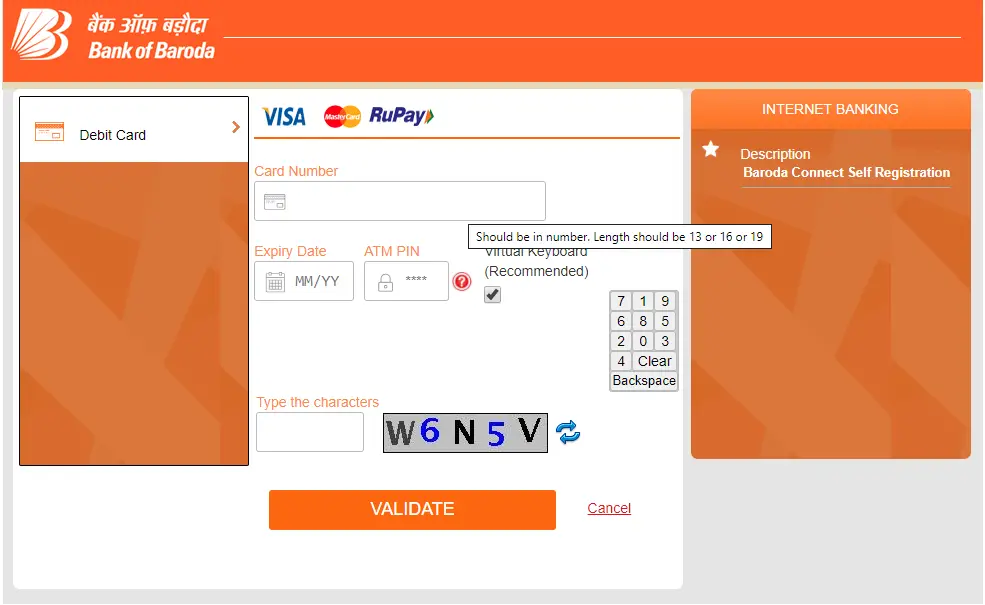

bank of baroda net banking not working

bank of baroda net banking new user registration not working? read this. bank of baroda net banking new user registeration shows errors many times. You need to retry after some time. You can register bank of baroda net banking using debit card also. If you’re encountering an error while trying to register for Bank of […]

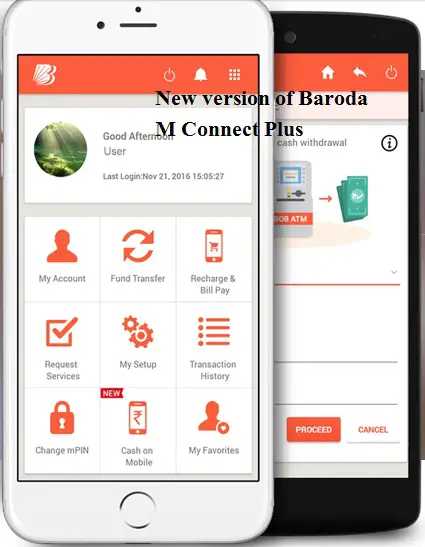

Bank of Baroda mobile banking use kaise karen

वैसे तो बैंक ऑफ बड़ौदा की काफी सारी mobile app मौजूद हैं पर सबसे अच्छी app है बैंक ऑफ बड़ौदा की मोबाइल बैंकिंग एप जिसका नाम है बडौदा एम कनेक्ट प्लस (baroda mobile banking app m connect plus) आज हम जानेंगे बैंक ऑफ बड़ौदा के मोबाइल बैंकिंग एप (baroda mobile banking app m connect plus) के […]

Activate mConnect Plus get Rs 50 cashback after 1st tran over rs 100

क्या आपको भी यह एसएमएस प्राप्त हुआ है बैंक ऑफ बड़ौदा की तरफ से “Activate mConnect Plus now, do your 1st txn over Rs 100, and get flat Rs.50 cashback. https://bit.ly/mconnect2. T&C Apply” How to get baroda mconnect plus 50 rs cashback? बैंक ऑफ बड़ौदा दे रहा है Baroda Mconnect plus me Rs 50 का […]

SBI PIN generation online

The process to SBI PIN generation online You can generation SBI PIN online through net banking or through SBI ATM also. SBI PIN generation is easy. Follow these steps for SBI pin generation online. SBI PIN generation online process Here is the full process for SBI PIN generation online Step i: Login to OnlineSBI.com site. […]

Net PNB Banking login transaction disabled or user disabled solution

Net PNB Banking (netpnb.com) Solution for transaction disabled or user disabled, contact the branch Net PNB Banking (for PNB customer): If you are facing a problem in Net PNB Banking like transaction disabled or user disabled, contact to branch, you need to enable the transaction. Net PNB Banking login PNB Net Banking: Sometimes you see the message in PNB net […]

SBI buddy will be closed from 30th Nov

Yes SBI will close its SBI Buddy app from 30th Nov., 2018. It is a wallet service by SBI bank but now this service will be closed. SBI has circulated this update on its website also. You must be aware if you are using this app. SBI Yono app is also very popular among SBI […]

Bank of Baroda customers can submit 15G or 15H form online now

15G or 15H form submit online using mobile. Read this… Friends, now you can submit 15G or 15H form online by net banking or mobile banking directly. No need to visit branch for this purpose. Many indian banks are providing this service to their customers. Last date of form submit Bank of baroda New […]