RBI inoperative account charge news Inoperative Accounts /Unclaimed Deposits in Banks- Revised Instructions in hindi. जब कोई खाता किसी वित्तीय लेन-देन की गतिविधि के आधार पर एक निश्चित समय तक सक्रिय नहीं रहता है, तो उसे ‘असक्रिय’ या ‘अनैच्छिक’ खाता कहा जाता है। ऐसे खातों में न्यूनतम शेष राशि की देखभाल के लिए कोई नियमित […]

Category: Digital banking

Digital banking is the digitization of all traditional banking activities. In simple language, Traditional banking means Cash Deposits, Withdrawals, and Transfers by the branch visit. Digital banking in India is popular since the demonetization. Online banking is easy to use in the form of net banking as well as mobile banking. Mobile banking is much faster than net banking.

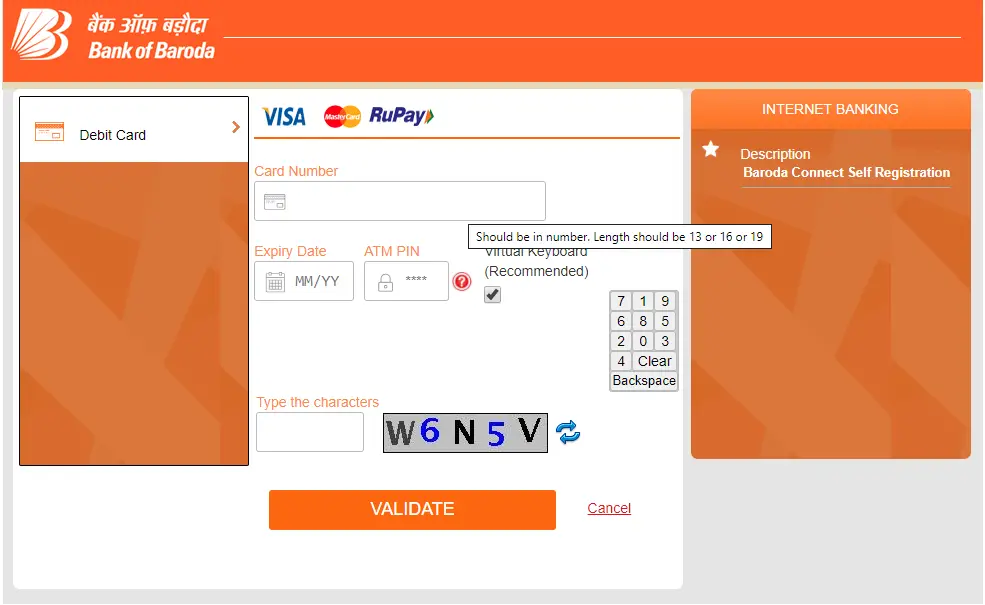

bank of baroda net banking not working

bank of baroda net banking new user registration not working? read this. bank of baroda net banking new user registeration shows errors many times. You need to retry after some time. You can register bank of baroda net banking using debit card also. If you’re encountering an error while trying to register for Bank of […]

AEPS debit txn disabled in your Ac message from bank

क्या आपके पास भी SMS आया है “AEPS debit txn disabled in your Ac message from bank” तो ये जरूर पढ़ें । एनपीसीआई ने एईपीएस से संबंधित धोखाधड़ी रोकने हेतु, बैंकों को एक अधिसूचना जारी की है, जिसमें अतिरिक्त सुरक्षा उपाय लागू करने का आग्रह किया गया है। बैंकों को निर्देश दिया गया है कि […]

BOB Bro account kya hai?

BOB bro ek saving account hai. बॉब ब्रो बचत खाता: विशेषताएंऑटो स्वीप सुविधा के साथ जीरो बैलेंस खाता।निःशुल्क एनईएफटी/आरटीजीएस/आईएमपीएस/यूपीआईनिःशुल्क चेक बुकनिःशुल्क डीडी/पीओनिःशुल्क एसएमएस अलर्टनिःशुल्क डीमैट खाता50 हजार रुपये तक का ओवरड्राफ्टप्रमुख संस्थानों के लिए 40 लाख रुपये तक का संपार्श्विक निःशुल्क शिक्षा ऋणकम आरओआई के साथ शून्य शिक्षा ऋण प्रसंस्करण शुल्कअन्य ऑफर:-बॉबवर्ल्ड ऐप के माध्यम […]

bob transaction password reset in hindi

आज हम इस वीडियो में सीखेंगे कि हम, बैंक ऑफ़ बडौदा की मोबाइल बैंकिंग ऐप ,यानि बॉब वर्ल्ड ऐप में transaction password reset कैसे कर सकते हैं। BOB World Transaction PIN एक चार अंकों की संख्या है जिसे ग्राहक बीओबी वर्ल्ड ऐप के पंजीकरण के समय सेट करता है। इससे पहले M Connect Plus ऐप में […]

mahila samman saving scheme in bank

Mahila Samman Saving Scheme में महिलाएं कम से कम 1000 रुपए और अधिकतम 2 लाख रुपए तक निवेश कर सकती हैं. इस स्कीmम में दो साल बाद डिपॉजिट राशि और ब्यारज को मिलाकर पूरा पैसा मिल जाता है.महिला सम्मा न बचत पत्र योजना यानि Mahila Samman Saving Scheme महिलाओं के लिए एक डिपॉजिट स्कीम है. […]

sbi atm charge kitna hai

SBI ATM charge kitna lagta hai? एसबीआई एटीएम कार्ड के लिए वार्षिक सेवा शुल्क आपके एटीएम कार्ड के प्रकार पर निर्भर करता है। उदाहरण के लिए, एसबीआई के क्लासिक डेबिट कार्ड के लिए, कोई वार्षिक रखरखाव शुल्क नहीं है यदि कार्डधारक रुपये की औसत तिमाही शेष राशि बनाए रखता है। उनके बचत खाते में 25,000। […]